Your Automobiles gst hsn code images are available in this site. Automobiles gst hsn code are a topic that is being searched for and liked by netizens now. You can Find and Download the Automobiles gst hsn code files here. Download all royalty-free photos.

If you’re searching for automobiles gst hsn code images information related to the automobiles gst hsn code interest, you have come to the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

Automobiles Gst Hsn Code. Find GST HSN Codes with Tax Rates. Spare Part S Go Down Thanks To Gst Team Bhp. TRACTORS OTHER THAN TRACTORS OF HEADING 8709 8701 10 00. Next 2 digits 90 indicates the sub-headings 6 digits HSN code is accepted worldwide.

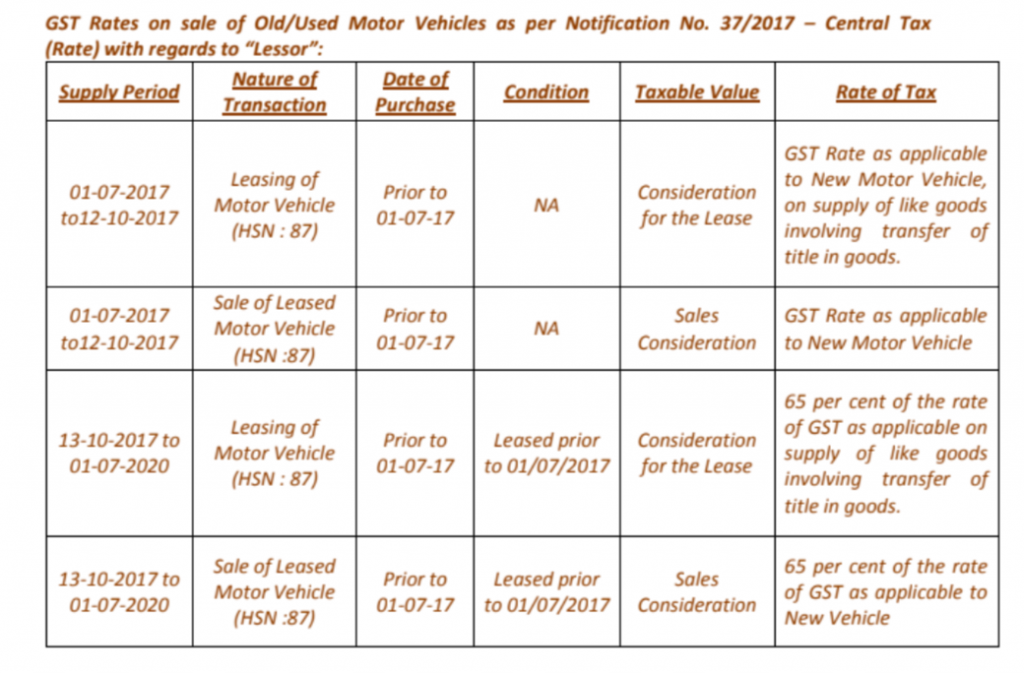

Applicability Of Gst On Sale Of Used Old Motor Vehicle Gst India Goods And Services Tax In India From gstindia.com

Applicability Of Gst On Sale Of Used Old Motor Vehicle Gst India Goods And Services Tax In India From gstindia.com

In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. Let us take an example that you need to add the HSN Code 61051010. List of goods 025 14-14 schedule iii. Spare Part S Go Down Thanks To Gst Team Bhp. You can access this list online from any of the trusted websites containing information about India tax laws. State Codes HSN Codes Country Codes Port Codes Currency Codes UQC Codes Tax Rates Pincodes Pincode State Mapping Pattern.

List of goods nil 1-13 schedule ii.

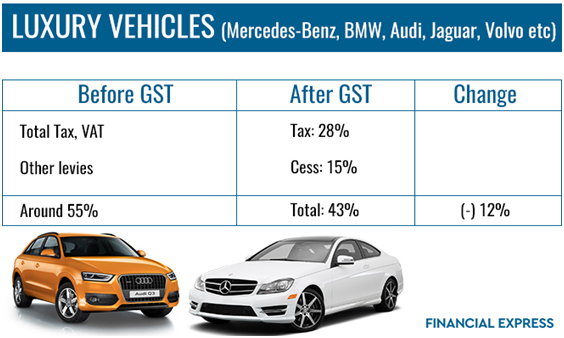

28 percent is the most applicable GST rate on cars. Httpscbic-gstgovingst-goods-services-rateshtmlWhatsapp EcomOne - 09411510841httpswamemessageB5YI2BV2IGHAA1. Find GST HSN Codes with Tax Rates. In the Search HSN Code field enter the HSN code 61051010. Gst rates and hsn codes for petrol diesel and auto lpg - GST Rate HSN codes. There is a proper list of exempted goods categorized into specific chapters.

Source: gsthelplineindia.com

Source: gsthelplineindia.com

Drafting machines pantographs protractors drawing sets slide rules disc calculators. All taxpayers registered under GST are required to file Form GSTR-3B wherein the net GST liability is calculated and then paid. Httpscbic-gstgovingst-goods-services-rateshtmlWhatsapp EcomOne - 09411510841httpswamemessageB5YI2BV2IGHAA1. Let us take an example that you need to add the HSN Code 61051010. TRACTORS OTHER THAN TRACTORS OF HEADING 8709 8701 10 00.

Source: indiatoday.in

Source: indiatoday.in

430 rows HSN Code. List of goods 5 17-51 schedule v. List of goods 3 15-16 schedule iv. You can access this list online from any of the trusted websites containing information about India tax laws. Drafting machines pantographs protractors drawing sets slide rules disc calculators.

Source: consultease.com

Source: consultease.com

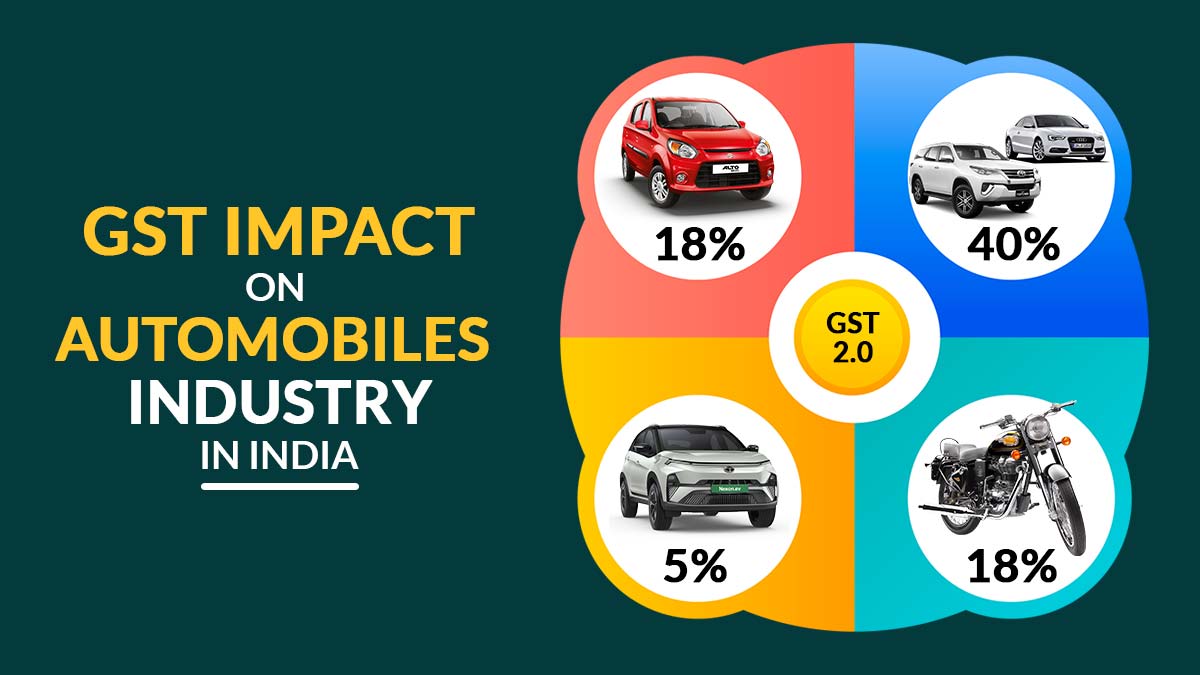

The next 2 digits 10 sub-classify the product tariff heading during import and export of supply. Furthermore GST on automobiles in India is levied at five different rates. Businesses can opt for HSN code which will help to save more time. To add the HSN Code perform the following steps. HSN codes are used to classify goods to calculate GST.

Source: alankitgst.com

Source: alankitgst.com

List of goods 5 17-51 schedule v. HSN Code 9017 Drawing marking-out or mathematical calculating instruments eg. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars. What are HSN codes. The presence of GST HSN code ensures that the invoicing operation of GST is in accordance with the global standards for product nomenclature.

Source: in.pinterest.com

Source: in.pinterest.com

Instruments for measuring length for use in the hand eg. List of goods 3 15-16 schedule iv. Spare Part S Go Down Thanks To Gst Team Bhp. Businesses can opt for HSN code which will help to save more time. Find GST HSN Codes with Tax Rates.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18. Furthermore GST on automobiles in India is levied at five different rates. Service Accounting Codes SAC is a unique code provided for recognition measurement and taxation of services. The autoTax from Masters India is a fully automated GST. The Goods and Services Tax Network GSTN has now made this process easier by auto-populating some values of Form GSTR-3B and presenting such data in the form of a PDF statement.

Source: pinterest.com

Source: pinterest.com

All taxpayers registered under GST are required to file Form GSTR-3B wherein the net GST liability is calculated and then paid. And it applies to all automobiles including personal and commercial vehicles. Yes as it will be difficult for the business to enter each and every detail of the dealer. In the Search HSN Code field enter the HSN code 61051010. Spare part s go down thanks to gst hsn code for cctv camera in india real truth behind synthetic oils hsn code for ing car accessories.

Source: taxguru.in

Source: taxguru.in

HSN codes are used to classify goods to calculate GST. Of Engine capacity not exceeding 1800 cc. There is a proper list of exempted goods categorized into specific chapters. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars Description.

Source: taxguru.in

Source: taxguru.in

What are HSN codes. Of Engine capacity not exceeding 1800 cc. The most essential goods and services attract nil rate of GST under Exempted Categories. Rate and hsn code of gst index schedule and goods gst rate page no. Instruments for measuring length for use in the hand eg.

Source: vakilsearch.com

Source: vakilsearch.com

List of goods 5 17-51 schedule v. 28 percent is the most applicable GST rate on cars. GST rates for all HS codes. 5 12 18 and 28. What are SAC codes.

Next 2 digits 90 indicates the sub-headings 6 digits HSN code is accepted worldwide. To add the HSN Code perform the following steps. HSN Code 8708 Parts and accessories for tractors motor vehicles for the transport of ten or more persons motor cars and other motor vehicles principally designed for the transport of persons motor vehicles for the transport of goods and special purpose motor vehicles of heading 8701 to 8705 nes. Of Engine capacity not exceeding 1800 cc. The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18.

Source: cleartax.in

Source: cleartax.in

List of goods 3 15-16 schedule iv. Start a discussion Unanswered Report Abuse. HSN is applicable under GST in. List of goods nil 1-13 schedule ii. List of goods 5 17-51 schedule v.

Source: taxguru.in

Source: taxguru.in

To understand GST on cars and automobiles thoroughly we have compiled this comprehensive guide. The Goods and Services Tax Network GSTN has now made this process easier by auto-populating some values of Form GSTR-3B and presenting such data in the form of a PDF statement. TRACTORS OTHER THAN TRACTORS OF HEADING 8709 8701 10 00. Yes as it will be difficult for the business to enter each and every detail of the dealer. You can access this list online from any of the trusted websites containing information about India tax laws.

Source: gstindia.com

Source: gstindia.com

The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18. The most essential goods and services attract nil rate of GST under Exempted Categories. The presence of GST HSN code ensures that the invoicing operation of GST is in accordance with the global standards for product nomenclature. Also click to see the HSN codes of Goods in India. Httpscbic-gstgovingst-goods-services-rateshtmlWhatsapp EcomOne - 09411510841httpswamemessageB5YI2BV2IGHAA1.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Drafting machines pantographs protractors drawing sets slide rules disc calculators. Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705. Parts Of Car Windsheild Glass Water Pump Spare Parts. List of goods 025 14-14 schedule iii. Let us take an example that you need to add the HSN Code 61051010.

Source: legalraasta.com

Source: legalraasta.com

Let us take an example that you need to add the HSN Code 61051010. Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705. HSN codes are used to classify goods to calculate GST. State Codes HSN Codes Country Codes Port Codes Currency Codes UQC Codes Tax Rates Pincodes Pincode State Mapping Pattern. The most essential goods and services attract nil rate of GST under Exempted Categories.

Source: taxguru.in

Source: taxguru.in

HSN codes are used to classify goods to calculate GST. The use of HSN codes allows you to save time and money during GST filing by filling the HSN codes it allows automation in GSTR. The procedure to find HS Code with tax rate is very simple. 28 percent is the most applicable GST rate on cars. Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705.

Source: indiafilings.com

Source: indiafilings.com

Start a discussion Unanswered Report Abuse. And it applies to all automobiles including personal and commercial vehicles. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars. The most essential goods and services attract nil rate of GST under Exempted Categories. The Harmonized System of Nomenclature HSN is an internationally accepted method of naming classifying and identifying products.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title automobiles gst hsn code by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.