Your Automobiles hsn code for gst images are available. Automobiles hsn code for gst are a topic that is being searched for and liked by netizens today. You can Get the Automobiles hsn code for gst files here. Find and Download all free images.

If you’re searching for automobiles hsn code for gst pictures information connected with to the automobiles hsn code for gst interest, you have pay a visit to the right site. Our website always gives you hints for seeking the highest quality video and image content, please kindly search and find more informative video content and images that match your interests.

Automobiles Hsn Code For Gst. The current rate of GST is 28 plus 3 cess applicable on cars. Also click to see the HSN codes of Goods in India. List of goods 025 14-14 schedule iii. The GST or Goods and Services Tax registration is now a must for each MSMEs and SMEs.

Pin On Gst From in.pinterest.com

Pin On Gst From in.pinterest.com

The current rate of GST is 28 plus 3 cess applicable on cars. HSN Code Product Description Import Data Export Data. Cabs for tractors motor vehicles for the transport of ten or more persons motor cars and other motor vehicles principally designed for the transport of persons motor vehicles for the transport of goods and special purpose motor vehicles of heading 8701 to 8705. Parts and accessories of the motor vehicles of headings 8701 to 8705. Furthermore GST on automobiles in India is levied at five different rates. And it applies to all automobiles including personal and commercial vehicles.

Where services are classified under the SAC Code and goods are classified under the HSN Code.

List of goods 12 52-79 schedule vi. List of goods 5 17-51 schedule v. TRACTORS OTHER THAN TRACTORS OF HEADING 8709 8701 10 00. HSN is applicable under GST in. The GST or Goods and Services Tax registration is now a must for each MSMEs and SMEs. Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705 Description.

Source: in.pinterest.com

Source: in.pinterest.com

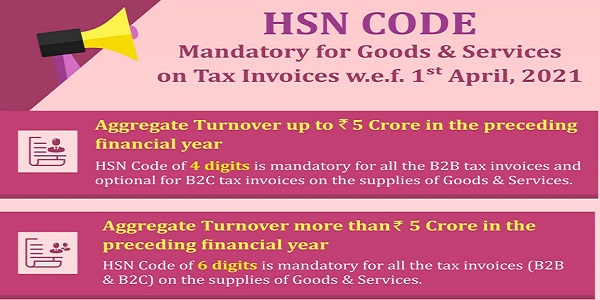

Next 2 digits 90 indicates the sub-headings 6 digits HSN code is accepted worldwide. Using GST SAC code the GST rates for services are fixed in five slabs namely 0 5 12 18 and 28. TRACTORS OTHER THAN TRACTORS OF HEADING 8709 8701 10 00. 28 percent is the most applicable GST rate on cars. What are HSN codes.

Source: aubsp.com

Source: aubsp.com

In easy language it is the serial number of different items goods and services in Goods and Services Tax GST. List of goods 12 52-79 schedule vi. ContentsProviding full-service automotiveMaintenance service schedule carAse certified techniciansMotor vehicles principally designedWhat is the Service tariff code for GST for Maintenance and repair services of fabricated metal products. Click on the wanted outcome to get more knowledge regarding the HSN code. Parts and accessories of the motor vehicles of headings 8701 to 8705.

Source: pinterest.com

Source: pinterest.com

The procedure to find HS Code with tax rate is very simple. The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18. 28 percent is the most applicable GST rate on cars. HSN is applicable under GST in. The use of HSN codes allows you to save time and money during GST filing by filling the HSN codes it allows automation in GSTR.

Source: in.pinterest.com

Source: in.pinterest.com

Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705. You can see below the complete list of hsn codes in GST in India for Services. Rate and hsn code of gst index schedule and goods gst rate page no. Maintenance and repair services of other goods nec. The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18.

Source: taxguru.in

Source: taxguru.in

Cabs for tractors motor vehicles for the transport of ten or more persons motor cars and other motor vehicles principally designed for the transport of persons motor vehicles for the transport of goods and special purpose motor vehicles of heading 8701 to 8705. Road tractors for semi-trailers. Here you can search HS Code of all products we have curated list of available HS code with GST website. HSN is applicable under GST in. Of Engine capacity not exceeding 1800 cc.

Source: pinterest.com

Source: pinterest.com

Of Engine capacity not exceeding 1800 cc. The current rate of GST is 28 plus 3 cess applicable on cars. List of goods 5 17-51 schedule v. List of goods 025 14-14 schedule iii. Under the GST regime it is mandatory for all the commercial enterprises on which the HSN system is relevant to get HSN code with a purpose to levy the proper price of taxes on the set by way of the concerned government of India.

Source: legalraasta.com

Source: legalraasta.com

Parts and accessories of the motor vehicles of headings 8701 to 8705. Using GST SAC code the GST rates for services are fixed in five slabs namely 0 5 12 18 and 28. The next 2 digits 10 sub-classify the product tariff heading during import and export of supply. Parts and accessories of vehicles of headings 8711 to 8713. Services Accounting Code also called as SAC Code is a classification system for services developed by the Service Tax Department of India.

Source: sk.pinterest.com

Source: sk.pinterest.com

In easy language it is the serial number of different items goods and services in Goods and Services Tax GST. To understand GST on cars and automobiles thoroughly we have compiled this comprehensive guide. Service Accounting Codes SAC is a unique code provided for recognition measurement and taxation of services. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars. 28 percent is the most applicable GST rate on cars.

Source: pinterest.com

Source: pinterest.com

28 percent is the most applicable GST rate on cars. List of goods 3 15-16 schedule iv. GST Rate in Percentage. Maintenance and repair services of transport machinery and equipment. 430 rows HSN Code.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Cabs for tractors motor vehicles for the transport of ten or more persons motor cars and other motor vehicles principally designed for the transport of persons motor vehicles for the transport of goods and special purpose motor vehicles of heading 8701 to 8705. Service Accounting Codes SAC is a unique code provided for recognition measurement and taxation of services. Similarly HSN is the six-digit uniform code which classifies 5000 products and is acceptable worldwide. Parts and accessories of the motor vehicles of headings 8701 to 8705. The Harmonized System of Nomenclature HSN is an internationally accepted method of naming classifying and identifying products.

Source: anbca.com

Source: anbca.com

28 percent is the most applicable GST rate on cars. Maintenance and repair services of transport machinery and equipment. The business has been providing full-service automotive maintenance repair and tire service. Using GST SAC code the GST rates for services are fixed in five slabs namely 0 5 12 18 and 28. The GST or Goods and Services Tax registration is now a must for each MSMEs and SMEs.

Source: abcaus.in

Source: abcaus.in

The HSN code provides standardization and global acceptance of the goods. Motor Cars And Other Motor Vehicles Principally Designed For The Transport Of Persons Other Than Those Of Heading 8702 Including Station Wagons And Racing Cars. Explore by HSN Code. 430 rows HSN Code. The next 2 digits 10 sub-classify the product tariff heading during import and export of supply.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Rate and hsn code of gst index schedule and goods gst rate page no. Also check out the GST rate on tractors cars and its accessories etc with HSN code. Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705 Description. List of goods 025 14-14 schedule iii. Plz provided me hsn code for car repairs charges.

Source: pinterest.com

Source: pinterest.com

Parts And Accessories Of The Motor Vehicles Of Headings 8701 To 8705 Description. The procedure to find HS Code with tax rate is very simple. Find GST HSN Codes with Tax Rates. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. Plz provided me hsn code for car repairs charges.

Source: in.pinterest.com

Source: in.pinterest.com

Maintenance and repair services of other goods nec. Where services are classified under the SAC Code and goods are classified under the HSN Code. The most essential goods and services attract nil rate of GST under Exempted Categories. Of Engine capacity not exceeding 1800 cc. GST Rate in Percentage.

Source: tax2win.in

Source: tax2win.in

The rate of GST payable for Authorised Service Stations for Motor Vehicles Repairs or servicing is expected to be 12 or 18. Of motorcycles including mopeds. 28 percent is the most applicable GST rate on cars. Click on the four-digit code to receive six and eight-digit code specifications for export-import views as well as the HSN code with GST Rate. The use of HSN codes allows you to save time and money during GST filing by filling the HSN codes it allows automation in GSTR.

Source: vakilsearch.com

Source: vakilsearch.com

Parts and accessories of vehicles of headings 8711 to 8713. Explore by HSN Code. HSN Code is Harmonised System Nomenclature. The use of HSN codes allows you to save time and money during GST filing by filling the HSN codes it allows automation in GSTR. Also check out the GST rate on tractors cars and its accessories etc with HSN code.

Source: pinterest.com

Source: pinterest.com

5 12 18 and 28. List of goods 5 17-51 schedule v. List of goods 12 52-79 schedule vi. Using GST SAC code the GST rates for services are fixed in five slabs namely 0 5 12 18 and 28. Click on the four-digit code to receive six and eight-digit code specifications for export-import views as well as the HSN code with GST Rate.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title automobiles hsn code for gst by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.