Your The macrs recovery period for automobiles and computers is images are ready. The macrs recovery period for automobiles and computers is are a topic that is being searched for and liked by netizens today. You can Download the The macrs recovery period for automobiles and computers is files here. Download all royalty-free photos.

If you’re searching for the macrs recovery period for automobiles and computers is pictures information connected with to the the macrs recovery period for automobiles and computers is keyword, you have pay a visit to the right site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

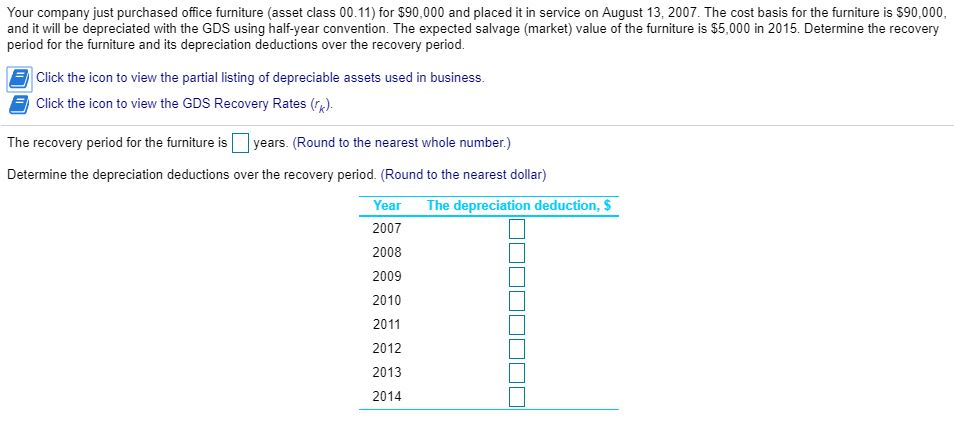

The Macrs Recovery Period For Automobiles And Computers Is. Your cost basis includes the purchase price title and registration fees and sales tax. 6 months of depreciation considered in the month the asset was used or disposed of service. The MACRS recovery period for automobiles and computers is. None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system.

How To Calculate Depreciation Using Macrs Fast Capital 360 From fastcapital360.com

How To Calculate Depreciation Using Macrs Fast Capital 360 From fastcapital360.com

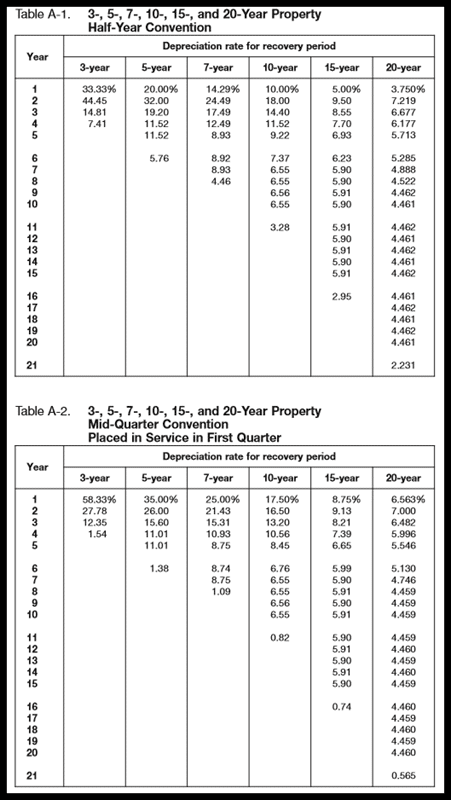

MACRS Depreciation is the tax depreciation system that is currently employed in the United States. ENone of the choices are correct. A Month and a half 15 months of depreciation in the month the asset was used or disposed of service. The MACRS recovery period for automobiles and computers is. However the maximum depreciation that may be deducted in 2019 on the automobile is limited to 2000 under the luxury car rules. Which is not an allowable method under MACRS.

None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system.

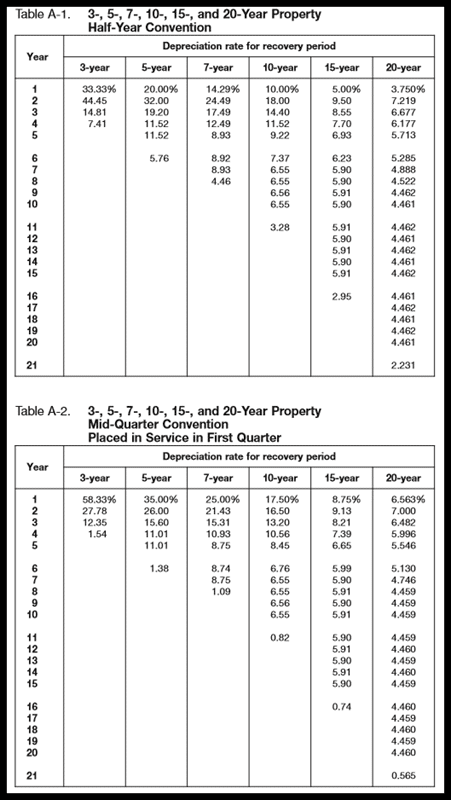

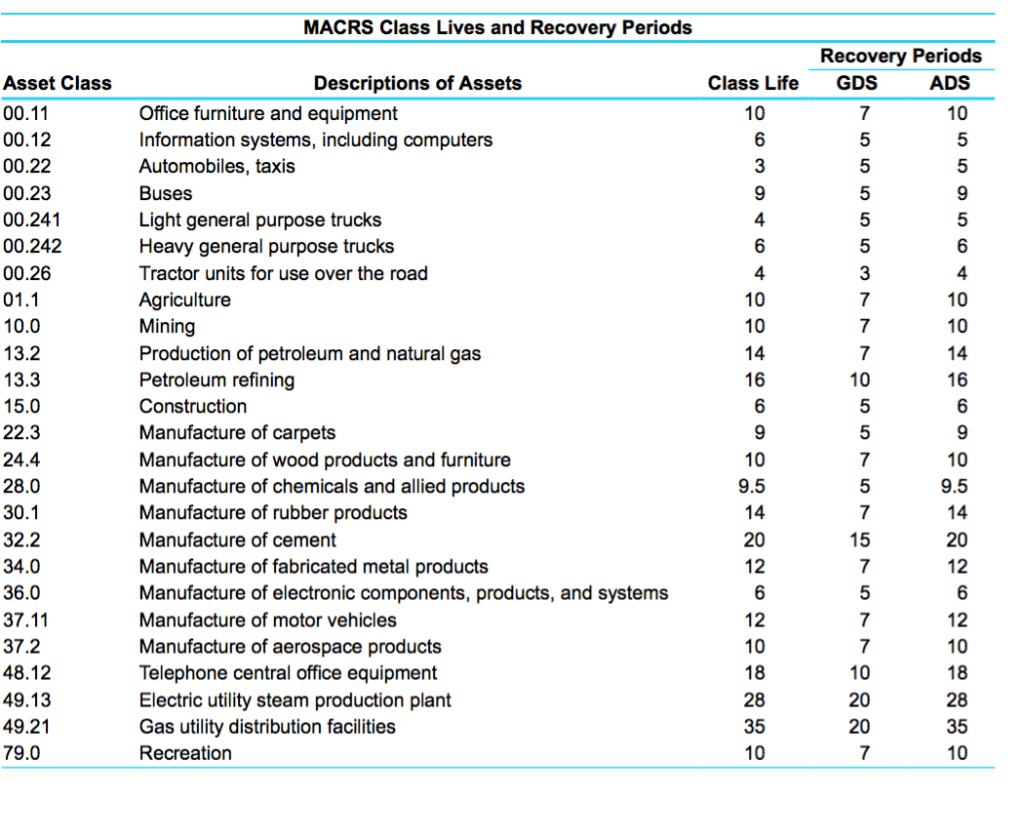

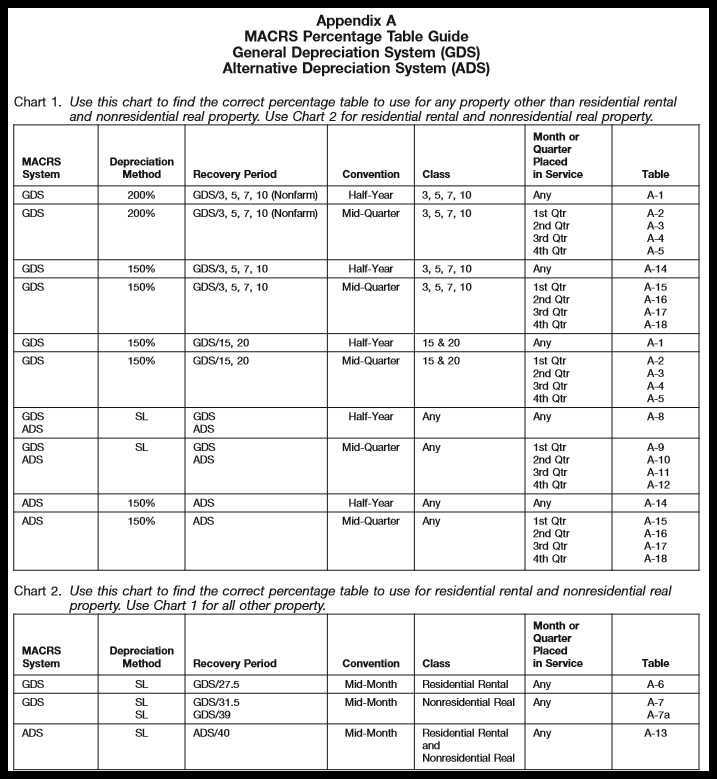

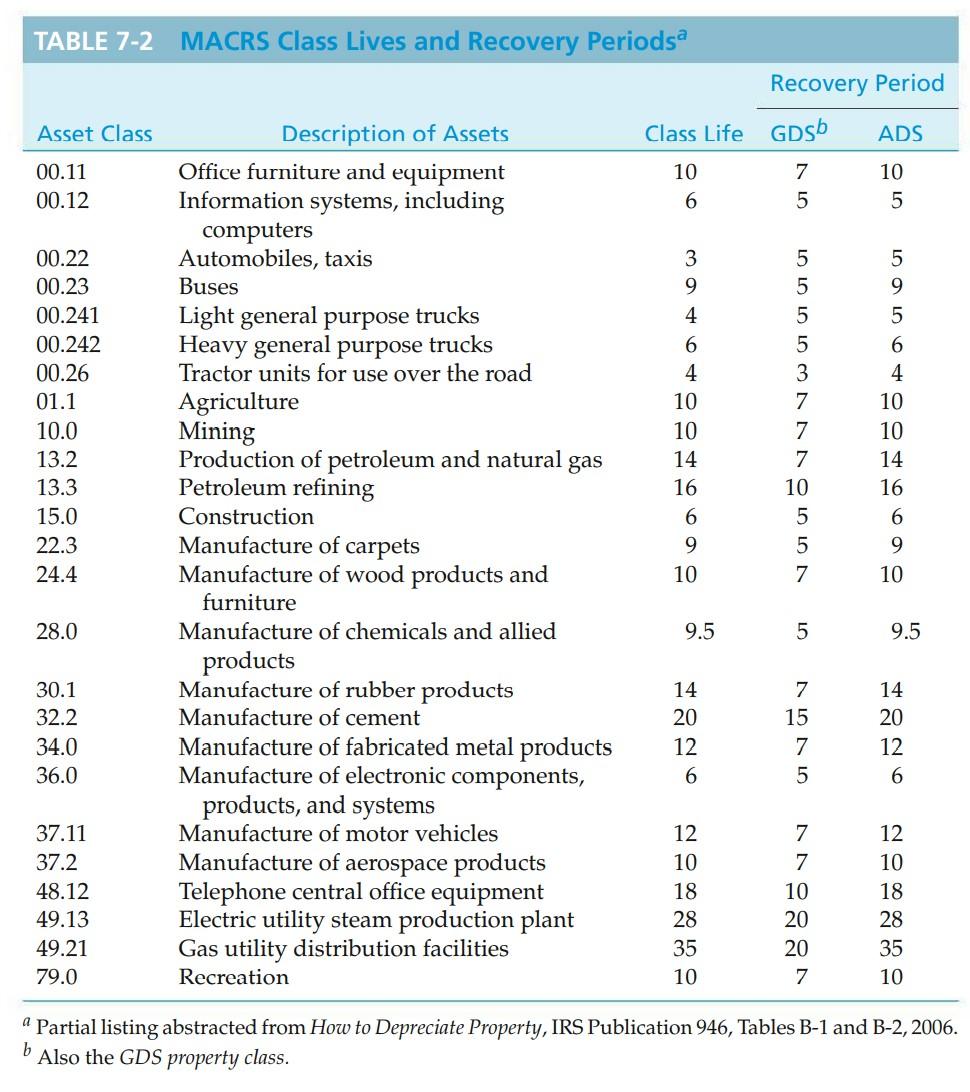

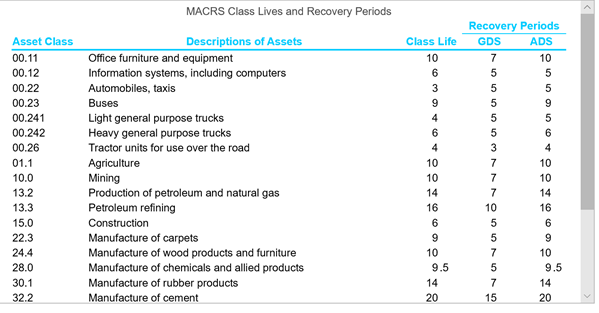

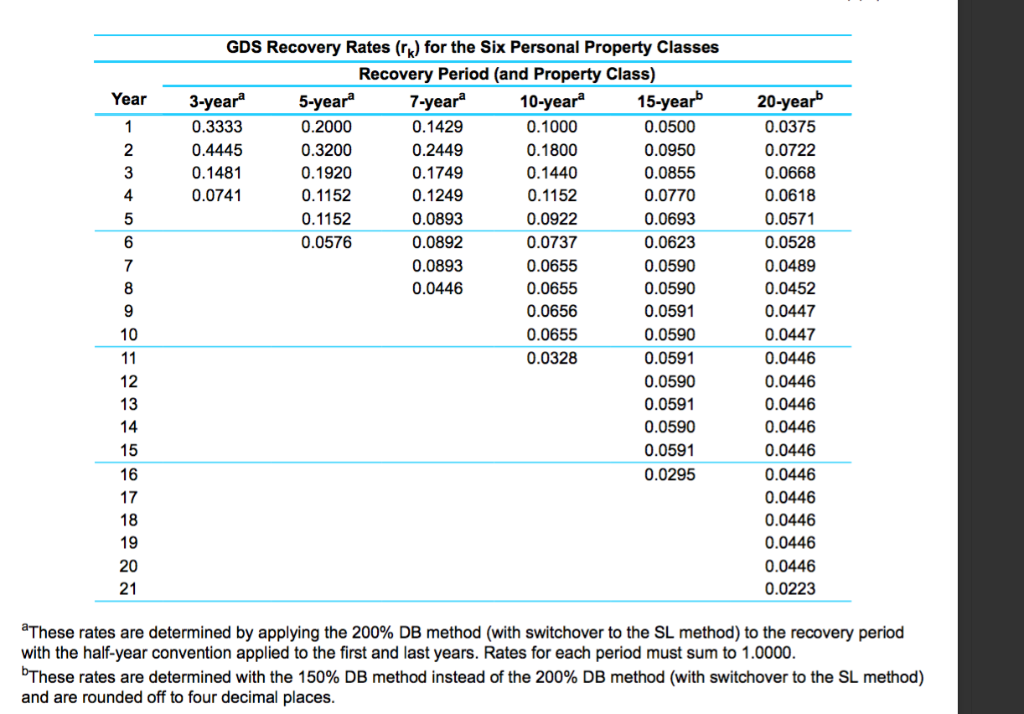

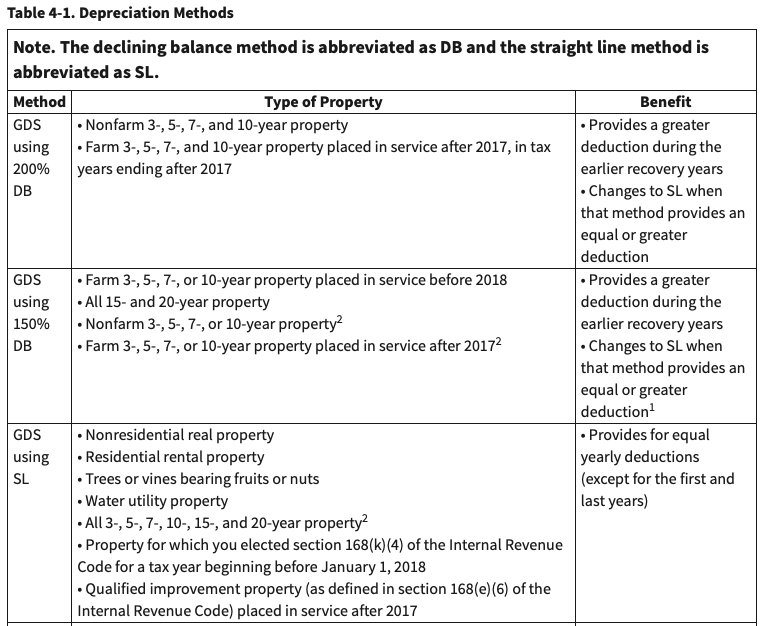

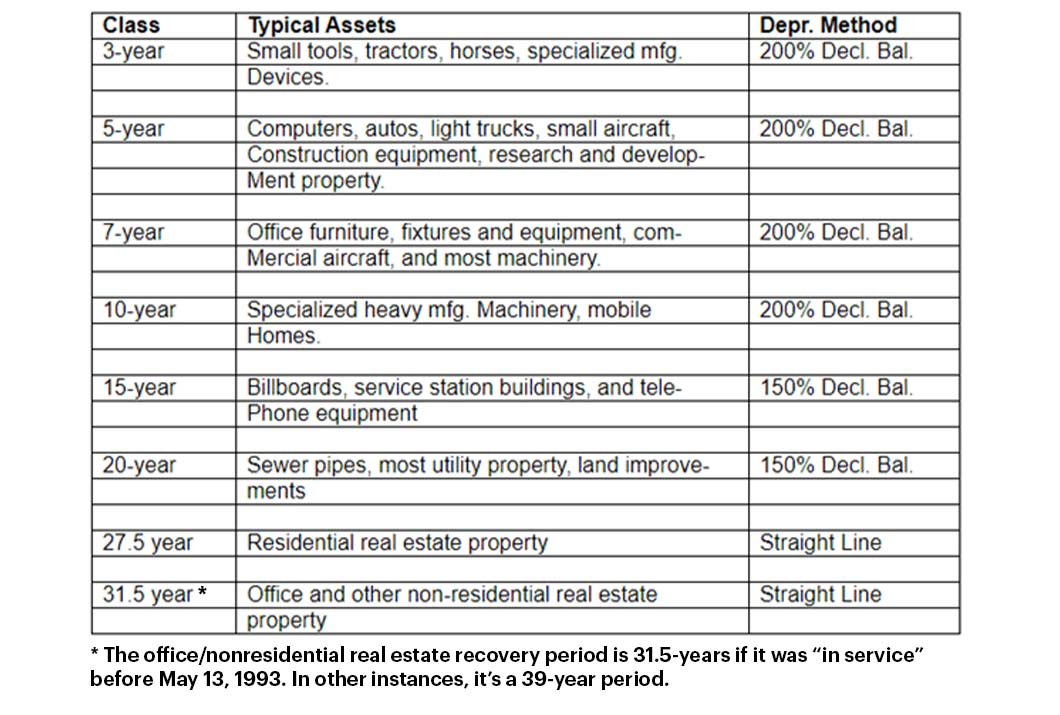

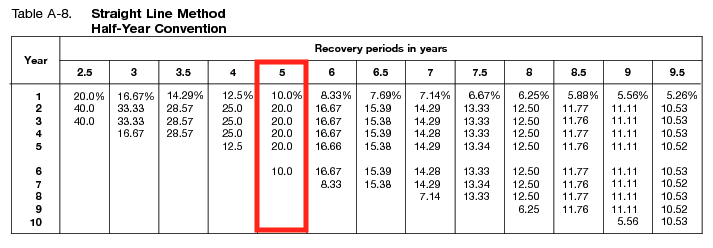

MACRS consists of two systems. ADS Recovery Periods1 Property Recovery Period Rent-to-own property 4 years Automobiles and light duty trucks 5 years Computers and peripheral equipment 5 years High technology telephone station equipment installed on. 11 rows If you look at the MACRS table shown below for 5-year propertysuch as computers youll. General MACRS Depreciation Rules GDS or Alternative MACRS Depreciation Rules ADS. Rules covering the use of the tables. The macrs recovery period for automobiles and computers is.

Source: chegg.com

Source: chegg.com

The macrs system puts fixed assets into classes that have set depreciation periods. The Macrs Recovery Period For Automobiles And Computers Is Chapter 10 Cost Recovery On Property Depreciation Depreciation Under Federal Income Tax Depreciation Rules. To determine the depreciation method to use refer to the Depreciation Methods table. Thus because of the half-year convention depreciation deductions can be expensed through June 30 2016. The MACRS recovery period for automobiles and computers is.

Source: researchgate.net

Source: researchgate.net

The Macrs Recovery Period For Automobiles And Computers Is Chapter 10 Cost Recovery On Property Depreciation Depreciation Under Federal Income Tax Depreciation Rules. General MACRS Depreciation Rules GDS or Alternative MACRS Depreciation Rules ADS. The MACRS recovery period for automobiles and computers is. 6 months of depreciation considered in the month the asset was used or disposed of service. Which is not an allowable method under MACRS.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Under the IRS Modified Accelerated Cost Recovery System or MACRS automobiles are classified as five-year property. None of these These assets recovery period is 5 years. The macrs recovery period for automobiles and computers is The macrs recovery period for automobiles and computers is. MACRS Depreciation is the tax depreciation system that is currently employed in the United States. A Month and a half 15 months of depreciation in the month the asset was used or disposed of service.

None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system. 6 months of depreciation considered in the month the asset was used or disposed of service. The MACRS recovery period for automobiles and computers is. Rules covering the use of the tables. Used in residential rental real estate activity certain green energy property.

Source: intuitiveaccountant.com

Source: intuitiveaccountant.com

ADS Recovery Periods The recovery periods for most property generally are longer under ADS than they are under GDS. Thus because of the half-year convention depreciation deductions can be expensed through June 30 2016. Your cost basis includes the purchase price title and registration fees and sales tax. A Month and a half 15 months of depreciation in the month the asset was used or disposed of service. Property described in asset class 0012 which is qualified technological equipment as defined in section 168i2 is assigned a recovery period of 5 years notwithstanding its class life.

Source: chegg.com

Source: chegg.com

A Month and a half 15 months of depreciation in the month the asset was used or disposed of service. The automobile is 5-year property under MACRS so the 200-declining balance method and a. Rules covering the use of the tables. None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system. MACRS consists of two systems.

Source: chegg.com

Source: chegg.com

The MACRS recovery period for automobiles and computers is. Under the IRS Modified Accelerated Cost Recovery System or MACRS automobiles are classified as five-year property. Based on the Depreciation Recovery Period table the machines and furniture have a recovery period of 7 years and the computer has a 5 year recovery period. General MACRS Depreciation Rules GDS or Alternative MACRS Depreciation Rules ADS. The MACRS which stands for Modified Accelerated Cost Recovery System was originally known as the ACRS Accelerated Cost Recovery System before it was rebranded to its current form after the enactment of the Tax Reform Act in 1986.

Source: pinterest.com

Source: pinterest.com

The MACRS recovery period for automobiles and computers is. The MACRS recovery period for automobiles and computers is. The MACRS recovery period for automobiles and computers is. Under the IRS Modified Accelerated Cost Recovery System or MACRS automobiles are classified as five-year property. Based on the Depreciation Recovery Period table the machines and furniture have a recovery period of 7 years and the computer has a 5 year recovery period.

Source: chegg.com

Source: chegg.com

6 months of depreciation considered in the month the asset was used or disposed of service. The recovery period would start on July 1 2009. The automobile is 5-year property under MACRS so the 200-declining balance method and a. The macrs system puts fixed assets into classes that have set depreciation periods. MACRS consists of two systems.

Source: fastcapital360.com

Source: fastcapital360.com

The MACRS which stands for Modified Accelerated Cost Recovery System was originally known as the ACRS Accelerated Cost Recovery System before it was rebranded to its current form after the enactment of the Tax Reform Act in 1986. MACRS consists of two systems. The MACRS recovery period for automobiles and computers is. The automobile has a recovery period seven years. The MACRS recovery period for automobiles and computers is 3 years 5 years 7 from ACC 322 at Eastern Kentucky University.

Source: pinterest.com

Source: pinterest.com

Automobiles taxis buses trucks computers and peripheral equipment office equipment any property used in research and experimentation breeding cattle and dairy cattle appliances etc. To determine the depreciation method to use refer to the Depreciation Methods table. Rules covering the use of the tables. Thus because of the half-year convention depreciation deductions can be expensed through June 30 2016. MACRS Depreciation is the tax depreciation system that is currently employed in the United States.

Source: fool.com

Source: fool.com

Property described in asset class 0012 which is qualified technological equipment as defined in section 168i2 is assigned a recovery period of 5 years notwithstanding its class life. The automobile is 5-year property under MACRS so the 200-declining balance method and a. The MACRS recovery period for automobiles and computers is. Your cost basis includes the purchase price title and registration fees and sales tax. The automobile has a recovery period seven years.

Source: studmed.ru

Source: studmed.ru

Automobiles taxis buses trucks computers and peripheral equipment office equipment any property used in research and experimentation breeding cattle and dairy cattle appliances etc. The Macrs Recovery Period For Automobiles And Computers Is Chapter 10 Cost Recovery On Property Depreciation Depreciation Under Federal Income Tax Depreciation Rules. Used in residential rental real estate activity certain green energy property. The MACRS recovery period for automobiles and computers is. However the maximum depreciation that may be deducted in 2019 on the automobile is limited to 2000 under the luxury car rules.

Source: fastcapital360.com

Source: fastcapital360.com

The MACRS recovery period for automobiles and computers is. MACRS consists of two systems. ADS Recovery Periods1 Property Recovery Period Rent-to-own property 4 years Automobiles and light duty trucks 5 years Computers and peripheral equipment 5 years High technology telephone station equipment installed on. The general depreciation system GDS and the alternative depreciation system ADS. Assets are grouped into property classes based on recovery periods of 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real property.

Source: fool.com

Source: fool.com

None of these These assets recovery period is 5 years. The macrs recovery period for automobiles and computers is The macrs recovery period for automobiles and computers is. General MACRS Depreciation Rules GDS or Alternative MACRS Depreciation Rules ADS. None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system. A Month and a half 15 months of depreciation in the month the asset was used or disposed of service.

Source: fool.com

Source: fool.com

Property described in asset class 0012 which is qualified technological equipment as defined in section 168i2 is assigned a recovery period of 5 years notwithstanding its class life. Rules covering the use of the tables. 6 months of depreciation considered in the month the asset was used or disposed of service. MACRS consists of two systems. This means you can depreciate the cost of your company cars over five years.

Source: holooly.com

Source: holooly.com

None of these These assets recovery period is 5 years. The MACRS recovery period for automobiles and computers is. Assets are grouped into property classes based on recovery periods of 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real property. Under the IRS Modified Accelerated Cost Recovery System or MACRS automobiles are classified as five-year property. None of these The modified accelerated cost recovery system MACRS is the current tax depreciation system.

Source: pinterest.com

Source: pinterest.com

The MACRS recovery period for automobiles and computers is. The recovery period would start on July 1 2009. MACRS Depreciation is the tax depreciation system that is currently employed in the United States. The MACRS recovery period for automobiles and computers is. 6 months of depreciation considered in the month the asset was used or disposed of service.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the macrs recovery period for automobiles and computers is by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.