Your What automobiles qualify for bonus depreciation images are ready. What automobiles qualify for bonus depreciation are a topic that is being searched for and liked by netizens now. You can Download the What automobiles qualify for bonus depreciation files here. Find and Download all royalty-free photos and vectors.

If you’re looking for what automobiles qualify for bonus depreciation images information linked to the what automobiles qualify for bonus depreciation keyword, you have visit the right site. Our website always provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

What Automobiles Qualify For Bonus Depreciation. Heavy vehicles new or used placed into service after September 27 2017 and before January 1 2023 qualify for a 100 first-year bonus depreciation deduction as well if business-related use exceeds 50. Switching gears to which business automobiles are eligible for 100 Section 179 deduction under the current tax laws after the TCJA. For these purposes passenger automobiles include trucks and vans. However if a heavy vehicle is used 50 or less for business purposes you must depreciate the business-use percentage of the vehicles cost over a six-year period.

Irs Sets Vehicle Depreciation Deduction Limits For 2017 Accountingweb From accountingweb.com

Irs Sets Vehicle Depreciation Deduction Limits For 2017 Accountingweb From accountingweb.com

115-97 permits additional first-year depreciation bonus depreciation for qualified property which includes passenger automobiles acquired and placed in service after Sept. However if a heavy vehicle is used 50 or less for business purposes you must depreciate the business-use percentage of the vehicles cost over a six-year period. IRS Announces 2021 Automobile Depreciation Deduction Limits and Inclusion Amounts. Under these rules the depreciation limit for a passenger automobile that qualifies for bonus depreciation is increased by 8000 for the first tax year. All in all your deductible amount on the 50000 cargo truck would be 37500 in the. The list of vehicles that can get a Section 179 Tax Write-Off include.

Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs.

Place the property in service. Computers were listed property under prior law but starting in tax year 2018 they are no longer classified as listed property so. Bonus depreciation increased to 100 for qualified purchases made after September 17 2017 and remains at 100 until January 1 2023. The following trucks and business automobiles qualify for 100 deduction in Year 1-Automobiles that can seat nine-plus passengers behind the drivers seat ie. Passenger automobiles qualify for bonus depreciation if they are new vehicles that are used more than 50 for business and the taxpayer did not elect out of bonus depreciation. The law known as the Tax Cuts and Jobs Act TCJA PL.

Source: gibbonsford.com

Source: gibbonsford.com

Hotel Airport shuttle vans etc. 10000 for the first year 16000 for the second year. Limits for passenger automobiles acquired before September 28 2017 that qualify for bonus depreciation are. If the taxpayer doesnt claim bonus depreciation the greatest allowable depreciation deduction is. For example small cars under 6000 lbs Luxury autos are capped at 18000 of depreciation in the first year 10000 if bonus deprecation is not taken due to luxury auto limitations the IRS has imposed to help discourage the depreciation of high value vehicles.

Source: thinkwithniche.com

Source: thinkwithniche.com

Changes to depreciation limitations on luxury automobiles and personal use property. Limits for passenger automobiles acquired before September 28 2017 that qualify for bonus depreciation are. For these purposes passenger automobiles include trucks and vans. Also there are top end deductions for different classes of vehicles. What Vehicles Qualify for the Section 179 Deduction in 2021.

Source: trustbgw.com

Source: trustbgw.com

27 2017 and before Jan. For these purposes passenger automobiles include trucks and vans. Table 2 provides the depreciation limits for automobiles placed in service during 2020 for which no bonus depreciation deduction appliesincluding when the taxpayer 1 does not use the automobile during 2020 more than 50 for business purposes or 2 elected out of the additional first year depreciation deduction or 3 acquired a used automobile that fails to satisfy the statutory rules. For purchased automobiles the. All in all your deductible amount on the 50000 cargo truck would be 37500 in the.

Source: classicfleet.com

Source: classicfleet.com

This can provide a huge tax break for buying new and used heavy vehicles. 179 expensing if used over 50 for business. Switching gears to which business automobiles are eligible for 100 Section 179 deduction under the current tax laws after the TCJA. Examples of suitably heavy vehicles include the Audi Q7 Buick Enclave Chevy Tahoe Ford Explorer Jeep Grand Cherokee Toyota Sequoia and lots of full-size pickups. Computers were listed property under prior law but starting in tax year 2018 they are no longer classified as listed property so.

Source: lvbwcpa.com

Source: lvbwcpa.com

Passenger automobiles qualify for bonus depreciation if they are new vehicles that are used more than 50 for business and the taxpayer did not elect out of bonus depreciation. Bonus depreciation doesnt have to be used for new purchases but must be first use by the business that buys it. Listed property consists of automobiles and certain other personal property. What Vehicles Qualify for the Section 179 Deduction in 2021. Place the property in service.

Source: calt.iastate.edu

Source: calt.iastate.edu

Changes to depreciation limitations on luxury automobiles and personal use property. The following trucks and business automobiles qualify for 100 deduction in Year 1-Automobiles that can seat nine-plus passengers behind the drivers seat ie. 10000 for the first year 16000 for the second year. Passenger automobiles qualify for bonus depreciation if they are new vehicles that are used more than 50 for business and the taxpayer did not elect out of bonus depreciation. Vehicles with a fully-enclosed cargo area.

Source: pktaxservices.com

Source: pktaxservices.com

Computers were listed property under prior law but starting in tax year 2018 they are no longer classified as listed property so. For these purposes passenger automobiles include trucks and vans. Gross vehicle weight can qualify for at least a. The IRS on Wednesday issued the limitations on depreciation deductions for passenger automobiles first placed in service in 2020 and the amounts of income inclusion for lessees of passenger automobiles first leased during 2020 Rev. Computers were listed property under prior law but starting in tax year 2018 they are no longer classified as listed property so.

Source: uhy-us.com

Source: uhy-us.com

Motor Vehicles 6000 lbs. Hotel Airport shuttle vans etc. The new law changed depreciation limits for passenger vehicles placed in service after Dec. Examples of suitably heavy vehicles include the Audi Q7 Buick Enclave Chevy Tahoe Ford Explorer Jeep Grand Cherokee Toyota Sequoia and lots of full-size pickups. To qualify for bonus depreciation the asset has to be used for business at least 50 of the time.

115-97 permits additional first-year depreciation bonus depreciation for qualified property which includes passenger automobiles acquired and placed in service after Sept. IRS Announces 2021 Automobile Depreciation Deduction Limits and Inclusion Amounts. Motor Vehicles 6000 lbs. Vehicles that can seat nine-plus passengers. 27 2017 and before Jan.

Source: windes.com

Source: windes.com

The IRS has announced the 2021 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger automobiles including vans and trucks in a trade or business. Hotel Airport shuttle vans etc. The IRS on Wednesday issued the limitations on depreciation deductions for passenger automobiles first placed in service in 2020 and the amounts of income inclusion for lessees of passenger automobiles first leased during 2020 Rev. 115-97 permits additional first-year depreciation bonus depreciation for qualified property which includes passenger automobiles acquired and placed in service after Sept. Bonus depreciation doesnt have to be used for new purchases but must be first use by the business that buys it.

Source: cohencpa.com

Source: cohencpa.com

The new law changed depreciation limits for passenger vehicles placed in service after Dec. SUVs and crossovers with Gross Weight above 6000 lbs. Heavy vehicles new or used placed into service after September 27 2017 and before January 1 2023 qualify for a 100 first-year bonus depreciation deduction as well if business-related use exceeds 50. For example vehicles with a gross vehicle weight GVW of 6000 pounds or less that limited to 8000 of bonus depreciation in the first year theyre placed in service. Place the property in service.

Source: financialsamurai.com

Source: financialsamurai.com

Also there are top end deductions for different classes of vehicles. For purchased automobiles the. Examples of suitably heavy vehicles include the Audi Q7 Buick Enclave Chevy Tahoe Ford Explorer Jeep Grand Cherokee Toyota Sequoia and lots of full-size pickups. The 100 additional first year depreciation deduction was created in 2017 by the Tax Cuts and Jobs Act and generally applies to depreciable business assets with a recovery period of 20 years or less and certain other property. 27 2017 and before Jan.

Changes to depreciation limitations on luxury automobiles and personal use property. Costs of qualified film or television productions and qualified live theatrical productions. For example vehicles with a gross vehicle weight GVW of 6000 pounds or less that limited to 8000 of bonus depreciation in the first year theyre placed in service. Listed property consists of automobiles and certain other personal property. Vehicles with a fully-enclosed cargo area.

Source: cornwelljackson.com

Source: cornwelljackson.com

Examples of suitably heavy vehicles include the Audi Q7 Buick Enclave Chevy Tahoe Ford Explorer Jeep Grand Cherokee Toyota Sequoia and lots of full-size pickups. 100 first-year bonus depreciation is only available when an SUV pickup or van has a manufacturers gross vehicle weight rating GVWR above 6000 pounds. Under these rules the depreciation limit for a passenger automobile that qualifies for bonus depreciation is increased by 8000 for the first tax year. Table 2 provides the depreciation limits for automobiles placed in service during 2020 for which no bonus depreciation deduction appliesincluding when the taxpayer 1 does not use the automobile during 2020 more than 50 for business purposes or 2 elected out of the additional first year depreciation deduction or 3 acquired a used automobile that fails to satisfy the statutory rules. What Vehicles Qualify for the Section 179 Deduction in 2021.

Source: accountingweb.com

Source: accountingweb.com

The purchase would qualify for the 25000 dollar limit Section 179 deduction. The list of vehicles that can get a Section 179 Tax Write-Off include. IRS Announces 2021 Automobile Depreciation Deduction Limits and Inclusion Amounts. For trucks vans and passenger vehicles which are used more than 50 for qualified business purposes the total deduction which includes both the Section 179 deduction and bonus depreciation is limited to 11560 for vans and trucks and 11160 for cars. If the taxpayer doesnt claim bonus depreciation the greatest allowable depreciation deduction is.

Source: lakelandford.com

Source: lakelandford.com

However if a heavy vehicle is used 50 or less for business purposes you must depreciate the business-use percentage of the vehicles cost over a six-year period. Table 2 provides the depreciation limits for automobiles placed in service during 2020 for which no bonus depreciation deduction appliesincluding when the taxpayer 1 does not use the automobile during 2020 more than 50 for business purposes or 2 elected out of the additional first year depreciation deduction or 3 acquired a used automobile that fails to satisfy the statutory rules. For example vehicles with a gross vehicle weight GVW of 6000 pounds or less that limited to 8000 of bonus depreciation in the first year theyre placed in service. Vehicles that can seat nine-plus passengers. In addition if the asset is listed property it must be used more than 50 of the time for business to qualify for bonus depreciation.

So they qualify for 100 first-year bonus depreciation and Sec. Heavy vehicles new or used placed into service after September 27 2017 and before January 1 2023 qualify for a 100 first-year bonus depreciation deduction as well if business-related use exceeds 50. So they qualify for 100 first-year bonus depreciation and Sec. To qualify for bonus depreciation the asset has to be used for business at least 50 of the time. Examples of suitably heavy vehicles include the Audi Q7 Buick Enclave Chevy Tahoe Ford Explorer Jeep Grand Cherokee Toyota Sequoia and lots of full-size pickups.

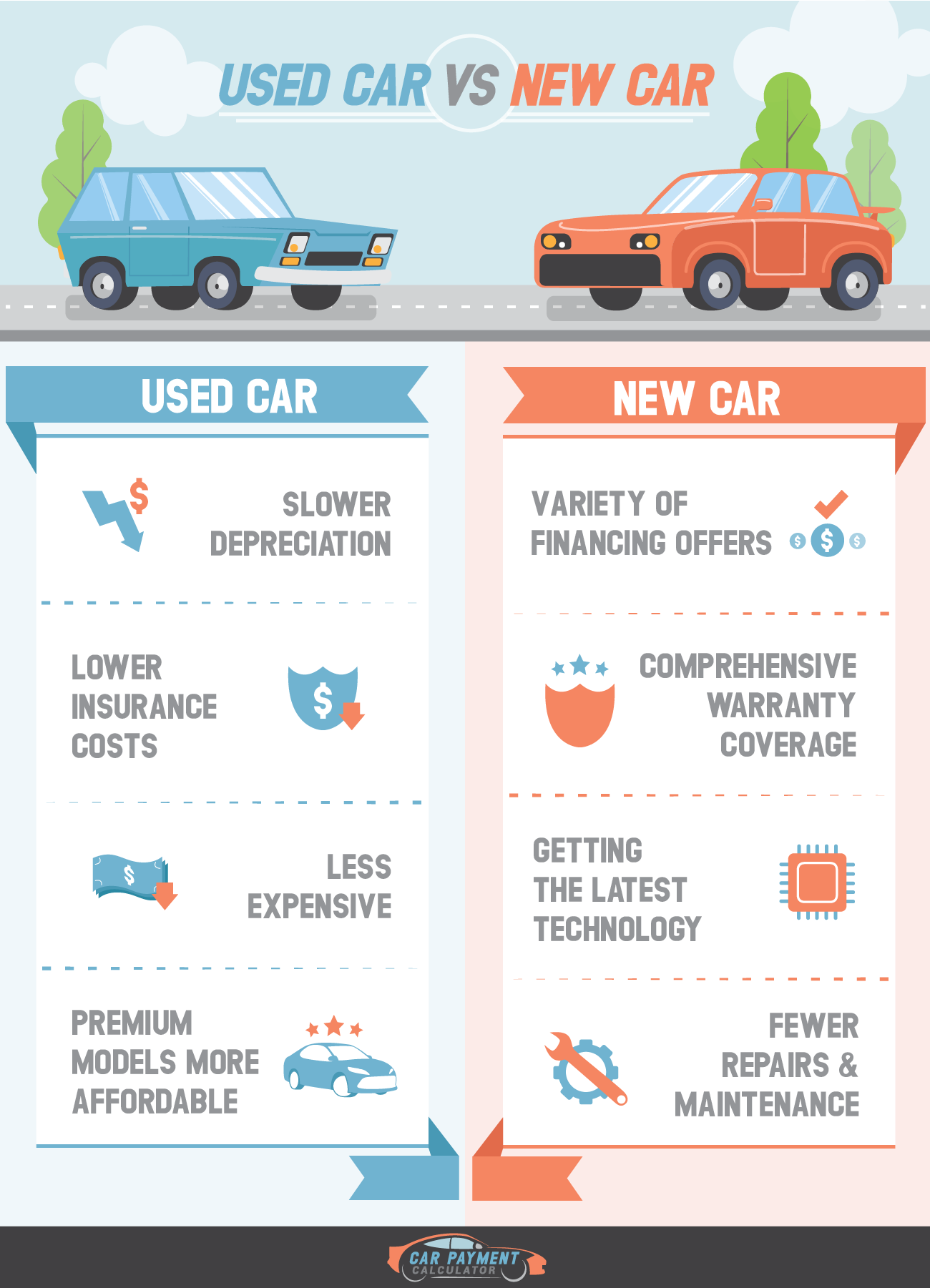

Source: carpaymentcalculator.net

Source: carpaymentcalculator.net

Also there are top end deductions for different classes of vehicles. Hotel Airport shuttle vans etc. Vehicles that can seat nine-plus passengers. However if a heavy vehicle is used 50 or less for business purposes you must depreciate the business-use percentage of the vehicles cost over a six-year period. It would also be able to deduct bonus depreciation for the first year in the amount of 12500 which is 50 of the non-deductible portion of the purchase price of the cargo truck.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what automobiles qualify for bonus depreciation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.